The idea of Grows came about when I took my wife to the hospital to give birth to our first kid.

On the way home, a sense of impending responsibility overwhelmed me: “a new person is about to appear — why should she be at the risk that I am taking?”

I spent the night with Excel, simulating different scenarios, cpmaromg different assets, calculating expected yields analyzing how power of compounding gets into play. I was looking for a simple and effective way to get my child out of the adventurousness of my approach to life. I wanted to find a tool that would guarantee her guture, no matter what happened to my affairs. Just to disconnect these two things.

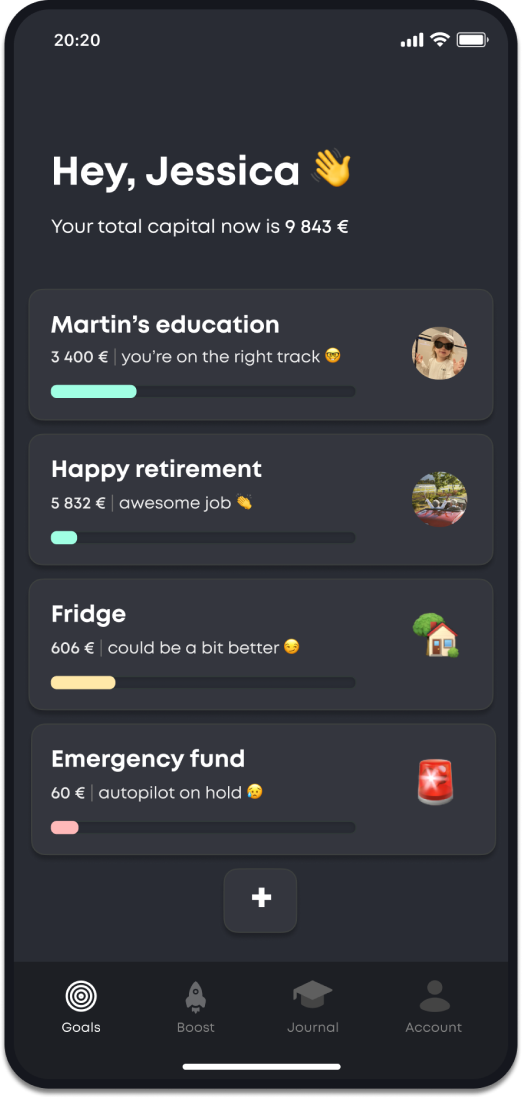

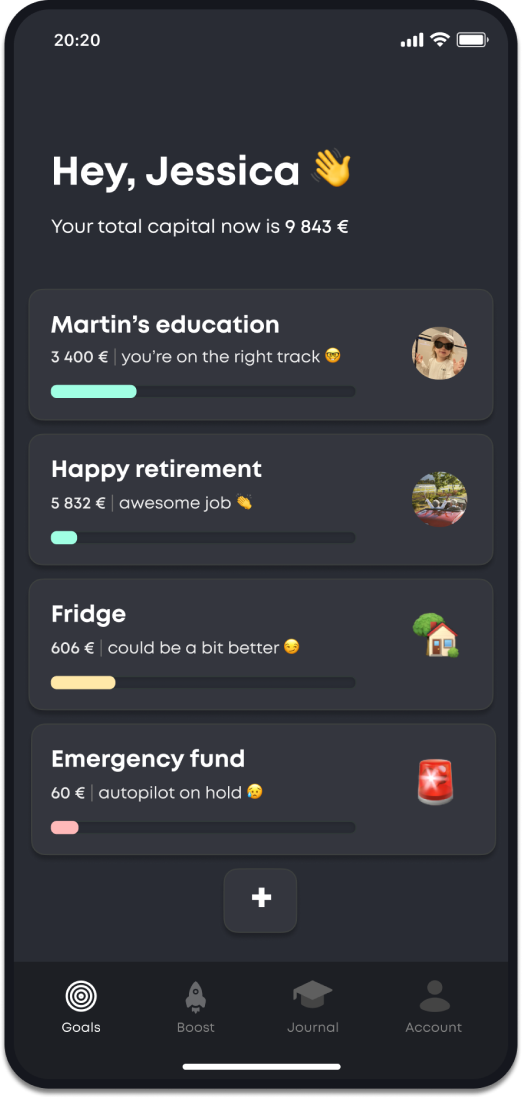

This is how I imagined the ideal instrument: my child's capital automatically grows as she grows up, using all the opportunities that the long-term horizon gifts — the power of compounding and the ability to invest aggressively in the first years.

I should not need to spend any time on this — I want to set it once and forget about it, just monitoring how it goes a few times a year.

This is how Grows was born. And a few hours later, our little Sophie was born 👶 When she becomes an adult, she will have passive income and be free to choose: to invest in her education, launch her own startup or anything she might have in mind. And I can continue do what I love and take risks without worrying about her future.